Afda Accounting Entry

National Senior Certificate South African Grade 12 Matric with entry into a Bachelors degree. This is due to the value of accounts receivable in the balance sheet should state at the cash realizable value and the period that expense incurs should match with the time that revenue earns.

Direct Write Off And Allowance Methods For Dealing With Bad Debt Accounting In Focus

It also includes.

Afda accounting entry. The allowance for doubtful accounts is paired with and offsets accounts receivableIt represents managements best estimate of the amount of accounts receivable that will not be paid by customersWhen the allowance is subtracted from accounts receivable the remainder is the total amount of receivables that a business actually expects to collect. The offsetting entry ie. ADA accounting helps increase the accuracy of your books.

Accordingly the company credits the accounts receivable account by 40000 to reduce the amount of outstanding accounts receivable and debits the Allowance for Doubtful Accounts by 40000. The entry does not impact earnings in the current period. What is the Allowance for Doubtful Accounts.

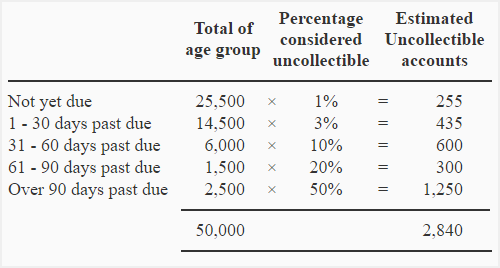

You can designate a percentage of your accounts receivable as uncollectible based on experience or the quality of your accounts receivable. This approach uses a of AR balance as an estimate for the AFDA provision. A reasonable way to begin the process is by reviewing the amount or balance shown in each of the balance sheet accounts.

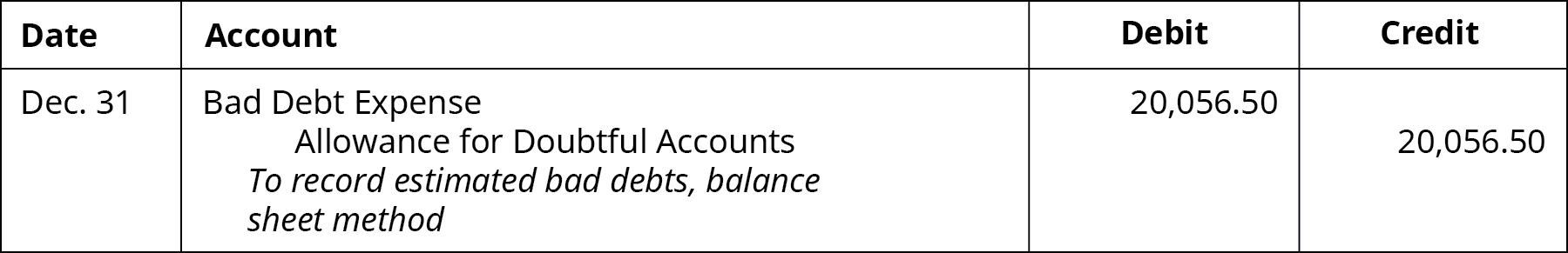

Steps are as follows. Debit is a PL account called Bad Debts Expense. This entry reduces the balance in the allowance account to 60000.

Of the remaining AR take a of AR balance as the appropriate AFDA. You may enter an AFDA degree if you have successfully completed the AFDA Higher Certificate course. A reserve for doubtful debts can not only help offset the loss you incur from bad debts but it also can give you valuable insight over time.

Balance Sheet Approach aka aging method. In the unlikely event you should receive payment you simply reverse the above entry and record the payment as usual. The allowance for doubtful accounts is a contra-asset account that is associated with accounts receivable and serves to reflect the true value of accounts receivable.

Adjusting entries assure that both the balance sheet and the income statement are up-to-date on the accrual basis of accounting. By predicting the amount of accounts receivables customers wont pay you can anticipate your losses from bad debts. Write off specific accounts that you know are uncollectible.

The National Skills Certificate National Certificate Vocational NCV on NQF level 4 with 3 fundamental subjects incl English above 60 and 4 vocational subjects above 70. Debit cash and credit accounts receivable. There are two ways to do this.

Properly making journal entry for bad debt expense can help the company to have a more realistic view of its net profit as well as making total assets reflect its actual economic value better. The amount represents the value of accounts receivable that a company does not expect to receive payment for. In accounting parlance this is referred to as an Allowance for Doubtful Accounts somewhat self explanatory or AFDA.

Adjusting Entries - Asset Accounts. This video walks you through the different types of journal entries you see that impact the AFDA allowance for doubtful accounts account.

Estimating Allowance For Doubtful Accounts By Aging Method Explanation Journal Entry And Example Accounting For Management

Writing Off An Account Under The Allowance Method Accountingcoach

Direct Write Off And Allowance Methods For Dealing With Bad Debt Accounting In Focus

Instantcert Credit Financial Accounting Lesson 42

Allowance For Doubtful Accounts Statement Of Financial Position Balance Sheet

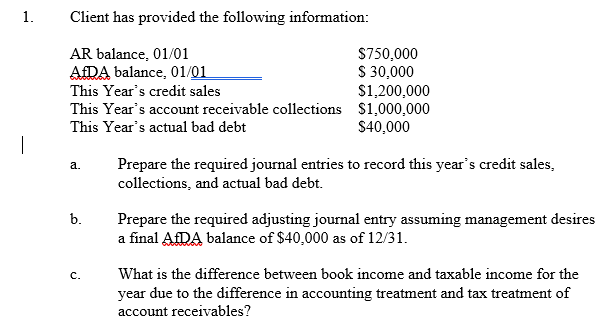

1 Client Has Provided The Following Information Ar Chegg Com

Estimating Bad Debts Allowance Method

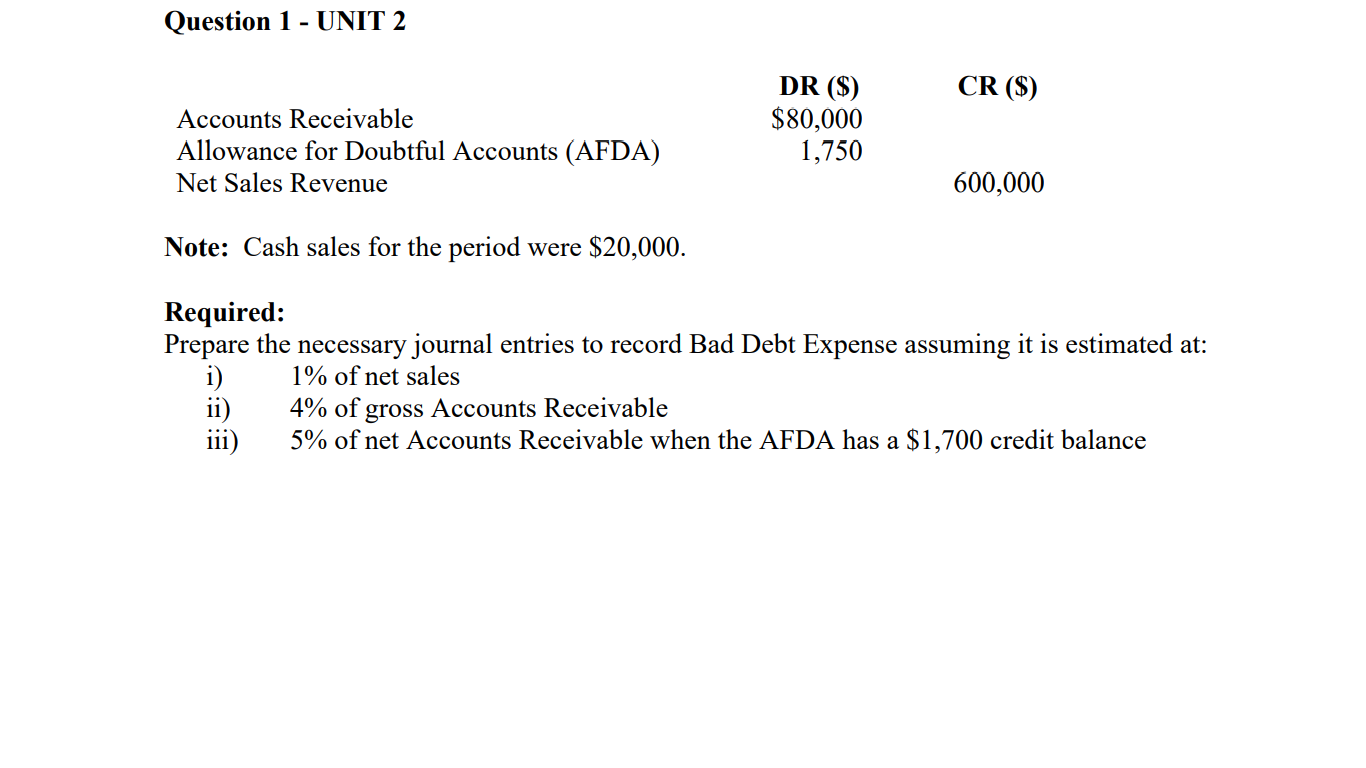

Question 1 Unit 2 Cr Accounts Receivable Chegg Com

Account For Uncollectible Accounts Using The Balance Sheet And Income Statement Approaches Principles Of Accounting Volume 1 Financial Accounting

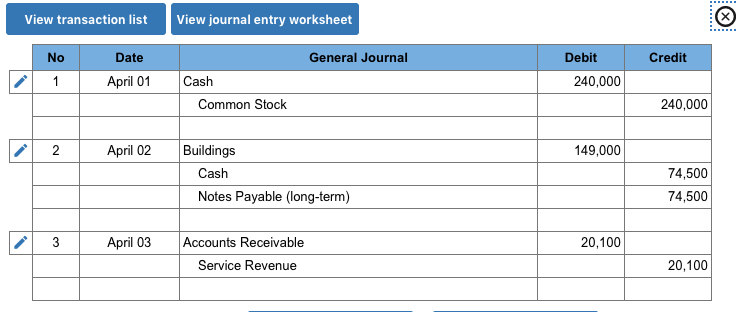

Solved Jose Garcia Opened A Business Called Garcia Chegg Com

Estimating Bad Debts Allowance Method

Account For Uncollectible Accounts Using The Balance Sheet And Income Statement Approaches Principles Of Accounting Volume 1 Financial Accounting

Allowance For Doubtful Accounts Statement Of Financial Position Balance Sheet

Writing Off An Account Under The Allowance Method Accountingcoach

Writing Off An Account Under The Allowance Method Accountingcoach

Instantcert Credit Financial Accounting Lesson 42

Account For Uncollectible Accounts Using The Balance Sheet And Income Statement Approaches Principles Of Accounting Volume 1 Financial Accounting

Instantcert Credit Financial Accounting Lesson 45

Instantcert Credit Financial Accounting Lesson 43